Whether you're looking to strengthen your digital marketing strategies for customer acquisition or for your overall business goals, these five marketing strategies for financial services are essential.

By nature, financial organisations are slow to change. Many banks and insurance companies have set ways to “do things” and usually initiating any activity will require a lengthy process and a longer time scale for implementation.

The digital world is picking up momentum every day. All companies that are reliant on customer acquisition and retention, and above all on developing great customer relationships, need to keep up. This goes especially for financial institutions which are so heavily dependent on retention rates and referrals.

Due to the conservative nature of financial institutions, they can be unwilling to change but the truth is that companies that adapt quickly will thrive and those that don’t will have to fight to survive. Equally, companies that implement effective digital marketing strategies will succeed in engaging customers the way they want to be engaged.

Here's how you can stay ahead of the pack:

1. Leveraging the value of big data

The potential of big data is enormous, which is something that companies understand and are trying to invest in. However, many still don’t know what exactly to do with it.

The real value in big data is to turn it into practical and actionable insights that are used as a basis for the business strategy.

Using the insights from big data to improve the customer experience is one of the best things you can do to secure the profitability of the business.

A great tip for financial marketers (and all marketers for that matter) is to not get lost in the concept of big data, but to think of the right data.

More data is not necessarily the better. It’s instead about getting the right data to support and enlighten your business strategies. Using big data to its full potential means a vital change in strategy.

Related content: 5 best practice tips for collecting customer data

2. Marketing automation

It's almost impossible to imagine a large organisation, such as a financial institution, managing their marketing without an automated system.

If your marketing services are automated it means you can streamline and automate (as the name implies), but more importantly measure tasks and work flows in one simple interface.

This way, you’ll be significantly more efficient and so are able to grow your revenue faster. Automation is the key component to a successful business as it measures tasks associated with e-commerce in relation to financial services. One of its objectives is to help companies with lead generation and management, measurement, email campaigns, social media programs and customer retention programs.

An automated marketing platform can include a triggering system, automatically sending out emails when people click on a certain link for example. You can then send out a personalised email to follow up on their interest.

The beauty of an automated system is then that it can track the success rate of campaigns. Measures to track are for example clicks and conversions, and you can then filter out the content that isn’t performing well to improve on your response rates.

Financial services organisations often have concerns around compliance in relation to digital marketing, as often they have to regulate operations based on certain standards and regulations. However, having marketing automation actually answers this problem as the respondents of the marketing can opt-in to communications, which ensures they then get the right content at the right time.

This way, the concerns around privacy and compliance get greatly reduced. A digital process is programmed to conform to regulations and the automated.

By using marketing automation, you’ll take most of the guess work out of the equation at the same time as you create a standard operating procedure for important tasks. This way you can also stop worrying about tedious marketing tasks and focus on more profitable activities. A great feature is also that you can integrate your social media platforms, for example to have an easy share function and tracking the activity and what type of content is performing well.

Related content: Empower your business with martech [Free Guide]

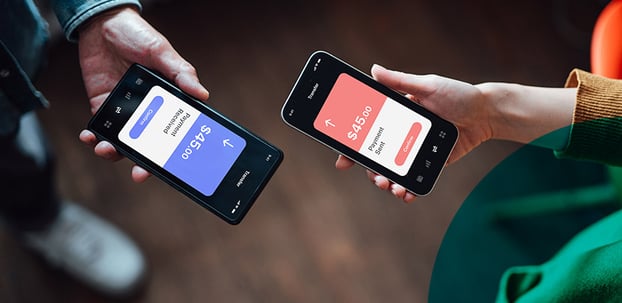

3. Going mobile gets personal

Yes, consumers are making buying decisions in a progressively congested market. In the banking world the new technologies that are taking over are not only disruptive, but requires the providers to keep up and be innovative or lose market share.

For financial services, using mobile in consumer communications really is the foundation of how to leverage digital means and develop long-lasting relationships across consumer life cycles.

Scaling activity to where people are, in ways that they want to be communicated with, instead of where marketers want them to be, drives further engagement. Trends that continue to drive innovation are personalisation, programmatic media buying and native advertising.

Related content: 4 ways modern marketing strategies (should) have changed your business

4. Retail banking shifts its fundamental model

Predictions within the financial services industry have been that banking will be more about the client experience than the traditional strategy which has focused on product innovation. The banking experience must be focused on the customer experience and its usefulness, less so than merely a profit centre for the bank.

It’s interesting how banking how become very digital or virtual in nature is often so dependent on marketing and distribution through retail outlets. Managing relationships via a complex network of branches is not only at a huge cost but overtakes the ability to generate profits for many banks.

This trend will lead to creating for example new distribution models and customer experience platforms which will eventually redefine the baking experience.

Related content: Digital disruption: How to excel in customer experience

5. B2B banking is an outdated term

Although we may be targeting a business with our B2B marketing, they’re still a person, and shall be communicated to in that sense. In this sense, the term B2B marketing is slightly outdated.

For financial services to capitalise on the opportunities that exist, financial marketers need to dig deep into data analysis on digital channels to uncover the insights and trends that prevail. Thereafter they can focus on deploying more personalised communications that are automated.

To leverage new technologies, marketers need to be ready to be more disruptive, which requires behavioural changes internally and for the organisation to manage additional compliance and regulatory challenges.

Innovative technologies aside, the main objective of a successful marketing strategy should always incorporate listening to your customers. Therein lies fantastic insights to help improve your business.

Related content: 5 reasons why we should listen to our customers

Want to learn the top industry tips for customer acquisition and retention with online marketing? Check out our free e-book by clicking on the button below.