If you want to get a complete picture of your business, incorporating your Net Promoter Score℠ (NPS) into your reporting is essential. Calculating your NPS does more than measure customer loyalty. It indicates how well your business is performing—and your potential to grow.

Related content: Net Promoter Score benchmarks for New Zealand and Australia.

How do you calculate a Net Promoter Score?

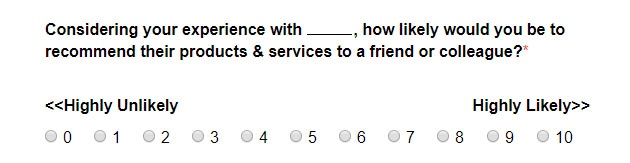

It all starts with one question to your customers: “How likely are you to recommend this company, product or service to a friend or colleague?”.

This question is answered with a scale from 0 (highly unlikely) to 10 (highly likely), usually presented like the below:

From here, responses are grouped into the following:

- Promoters: responses from 9-10.

- Passives: responses from 7-8.

- Detractors: responses from 0-6.

The NPS formula

To get your overall NPS score, subtract the percentage of detractors from the percentage of promoters.

Promoter % – Detractor % = NPS

For example, if you had 100 responses with 60 Promoters (Promoters = 60 per cent) and 20 Detractors (Detractors = 20 per cent) this formula would become:

60 – 20 = A Net Promoter Score of +40

This means a business' NPS can range from -100 to +100. The higher the score, the higher your customers' loyalty.

What is a good NPS score?

NPS varies between industries, but Bain & Co considers a good score as something between +30 to +40. Anything between +50 and +80 is usually seen as outstanding.

Related content: What is a good Net Promoter Score?

Common NPS calculation mistakes

While NPS is a simple measure to implement, understand and utilise, it does rely on following a strict set of best practices to ensure accurate measurement. Breaching these best practices can result in a score that is either too low or too high. In particular, when the score is 'too high', while tempting to ignore, this can be the more damaging inaccuracy.

For example, if a company believed its NPS was a solid 80 (a world-class score), but this score wasn't reflecting reality, they could be missing out on incredibly valuable insights from their audience that could improve their overall customer experience.

A good score must also be an accurate score.

Here is a brief summary of the most common mistakes companies make:

- Asking leading questions on the survey.

- Asking too many questions on the survey.

- Surveying a large number of people at once, rather than spreading it out over time.

- Surveying the same customers multiple times over a short period of time.

- Cherry-picking only the positive responses.

- Using surveying methods that can inherently produce bias (face-to-face vs online, for example).

- Tying financial rewards to higher scores.

- Revealing the inner workings of how NPS works before the survey.

You can find out more detail on these common mistakes (including how to avoid them) through the below resources:

- 5 ways to unintentionally inflate your Net Promoter Score percentage

- Are you making the 4 biggest Net Promoter® Score mistakes?

- 3 ways you might be skewing your Net Promoter Score results

Related content: Why choose the Net Promoter Score over other measurement tools?

What to do with your NPS now

Your NPS is primarily used as a way of measuring customer loyalty, but it can also be used in a number of different ways to benefit your business. These include:

- Using your NPS as a business KPI.

Many businesses choose to use NPS as a company-wide key performance indicator as well as individual performance metrics for individual customer service stars. While the CEO is likely to be primarily concerned with overall NPS, even the newest staff member can benefit from a personalised NPS-driven KPI. - Benchmark against the competition.

NPS is used all over the world in a wide range of industries, allowing any business that utilises it to compare themselves with other organisations no matter where on the globe they are. - Compare teams and departments.

Having individual net promoter scores for each section of a business also allows identification of any skill or knowledge gaps. If two teams who deal with the same issues find themselves with very different NPS, then this may be an opportunity to capitalise on the better-performing team and spread what's working, around.

Related content: Your top 3 Net Promoter Score problems solved

The benefit of calculating your NPS

NPS is used around the world to measure customer loyalty. It lets you see what customers think of you. Moreover, it establishes the likelihood of a customer recommending your product or service to another person. In other words, it gauges your chances of gaining new and – most importantly – returning business.

Returning business equals profit

It’s well known that it costs more to acquire a new customer than to retain one. Research from Bain & Co has shown the strong correlation between customer retention and company profit. In financial services, they report, improving customer retention by 5 per cent can lead to a 25 per cent profit increase.

Knowing your NPS and seeking to improve it—by implementing customer feedback for instance—increases your chances of gaining new and repeat business. The higher the score, the more stable and sustainable your company is. And the research agrees. Companies with top NPS's in their industries perform two times better than their competitors.

Related content: The 4 biggest factors that impact your Net Promoter Score percentage

Better understanding of customers

Top performing companies often include strategic questions in their surveys to identify where they could improve. In some cases, they’ll even follow up with their detractors to better understand where they went wrong.

All up, it leads to better customer experiences, higher satisfaction, improved customer loyalty and, ultimately, greater business outcomes.

Related content: 7 ways to use NPS to improve performance holistically

A tool for better business

NPS can be a bit of a reality check for businesses. However, it’s one of the best ways to learn what customers really think, and to gauge how your business is performing as a whole. Without it, you could end up really steering off the road. With it, you—and your customers—are undoubtedly in for a smoother ride.

Related content: 5 reasons why modern businesses need a Net Promoter Score system

Your NPS is only relevant in comparison to your peers in your industry. If you're wondering how you rank, you can access our free benchmarks below: